Health and Social Care Levy

On the 7th September 2021, the government announced a new Health and Social Care Levy. This is to provide more funding for health and social care.

The change will come in two parts:

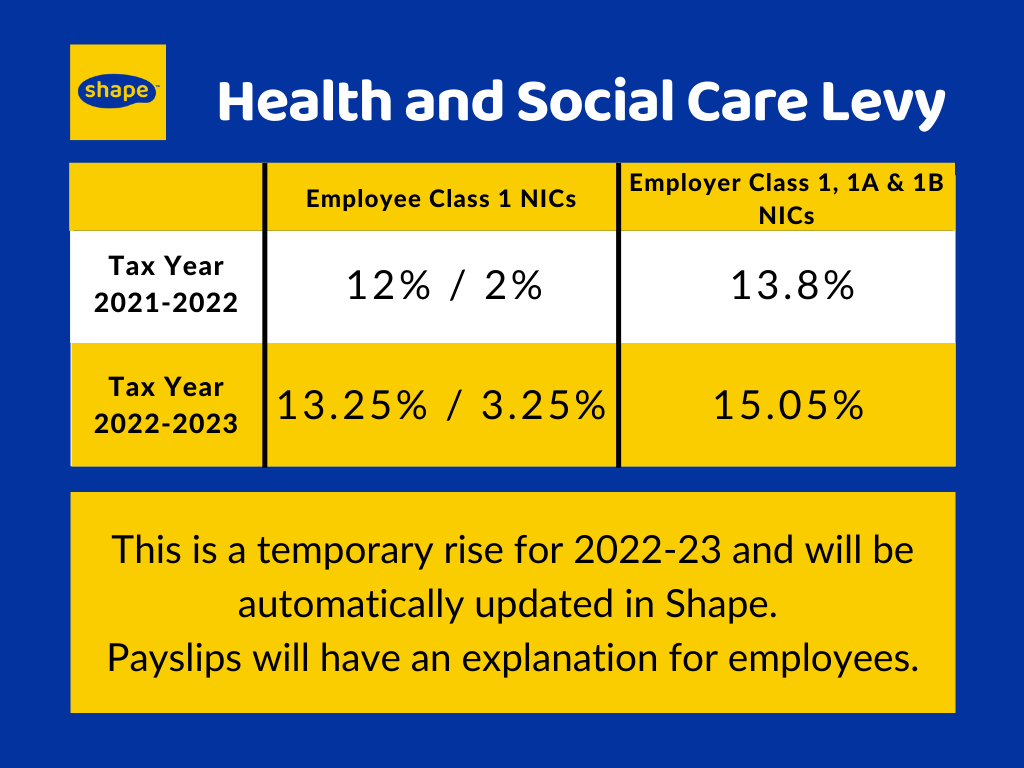

For 2022-23: There is going to be a temporary 1.25% rise in NICs for employees Class 1 (primary) and employers Class 1 (secondary), Class 1A and Class 1B. The additional rate will not apply below the primary and secondary thresholds.

Those individuals above State Pension Age that don’t pay NICs will not be affected.

Currently the rates for employees is 12% / 2% and employers is 13.8%. These will increase to 13.25% and 15.05%.

Payslips will need to have a note on them explaining that the percentage increase relates to the Health and Social Care Levy. This will be available in Shape.

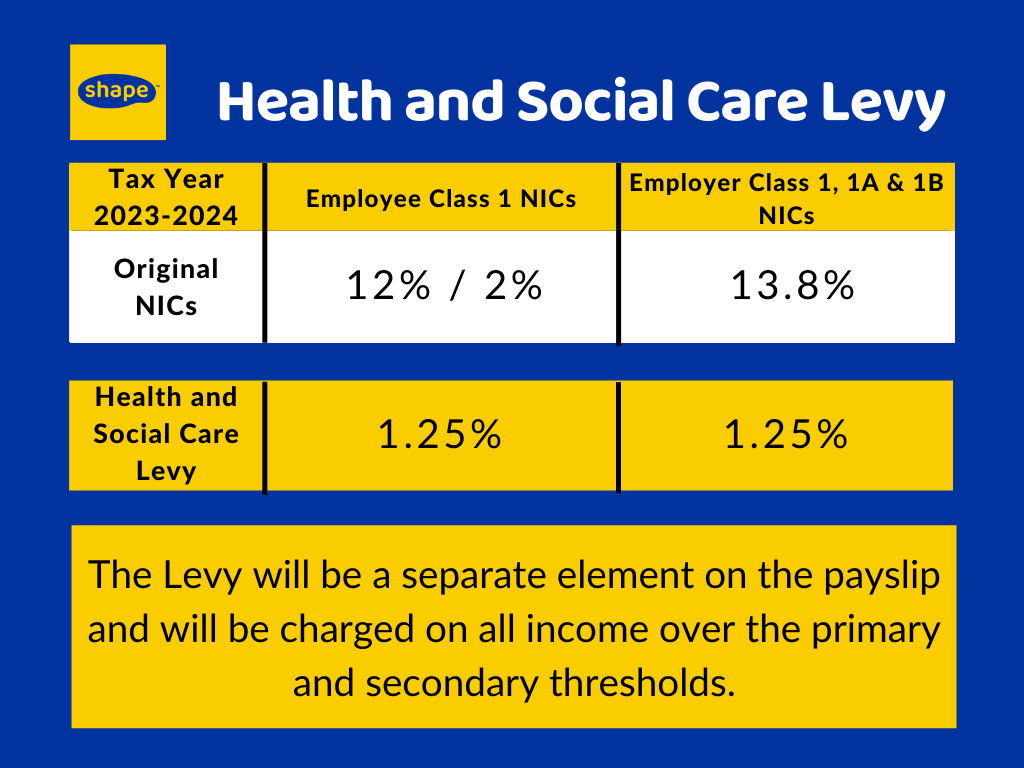

From 2023-2024: The NIC’s return to their original percentages and the levy will be a separate element on the payslip called the Health and Social Care Levy. The Levy will be charged on all income over the primary and secondary thresholds including those over state pension age.

All changes will be automatic in Shape.

Further details on the plans for health and social care levy can be found in Building Back Better: Our Plan for Health and Social Care.