The Shape Platform All the tools you need in one place

Rich in features and easy to use.

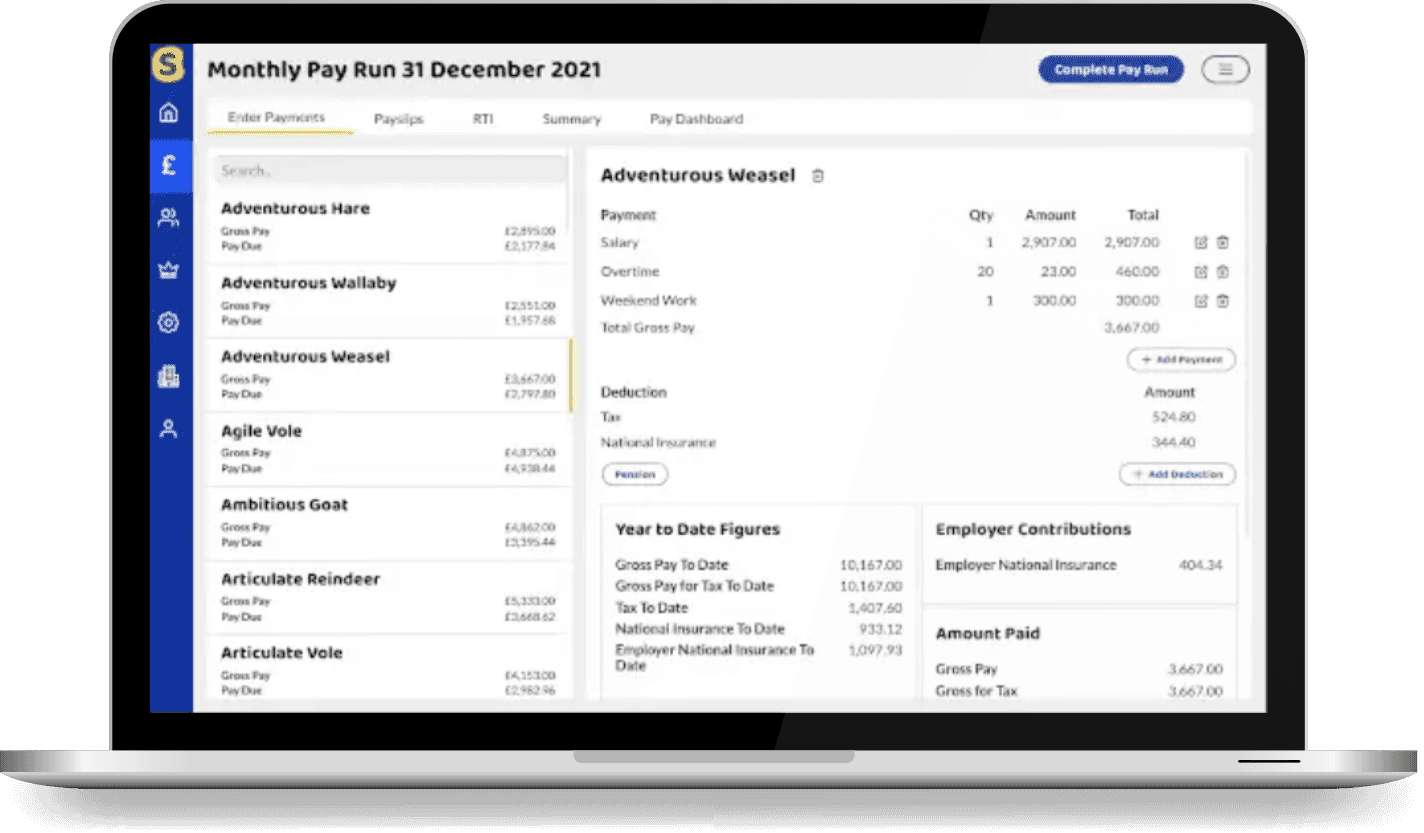

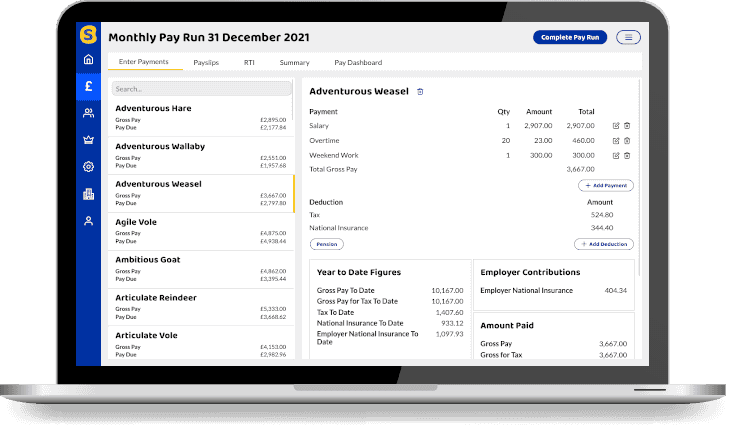

Shape uses intuitive and easy navigation. We have included helpful tips and info throughout so you can quickly complete your payroll tasks whether you are a novice, or an experienced payroll professional.

All the things you need

The Shape platform includes everything a business needs for payroll, from employee records to tax and national insurance contributions.

Creating payslips and payroll documents has never been simpler and with our RTI (Real Time Information) submissions, you can be sure to be on top of your payroll at all times.

Tax & NI

Our software calculates Tax, NI, Student Loans and Postgraduate Loans in real time as you edit your employees’ payslips.

We handle all the software updates so you can be sure you are always making the correct deductions to comply with current legislation.

RTI

Our software has been recognised by HMRC to file Real Time Information (RTI) since 2018.

Full Payment Submission (FPS) and Employer Payment Summary (EPS) are automatically generated when you complete a pay run and are available for review before you submit them.

Payslips

Securely deliver payslips to your employees via our self service portal, The Shape Hub.

Generate password protected PDF payslips to print or email to your employees.

Starters & Leavers

Setting up new employees is easy with our starter wizard, and if they don't give you a P45 the system will automatically set the correct tax code for you.

You can make an employee a leaver in just a couple of clicks, and a P45 will be generated after their final payment.

Pensions

Shape can handle your automatic enrolment process including postponement periods for new starters and assessing your employees every time they are paid.

Contributions are calculated as you edit your payments, and can be uploaded to NEST in a couple of clicks. Contribution files for other pension providers are available.

PAYE Notices

Check for new tax code (P6 & P9), student/postgraduate loan (SL1, SL2, PGL1, PGL2) and NINO changes (NVR, NOT) with 1 click.

Notices are matched to your employee records and can be applied when due.

Making your life easier

As well as the functions you’d expect from a payroll system, the shape platform is packed with a whole bunch of great features that help make payroll easy.

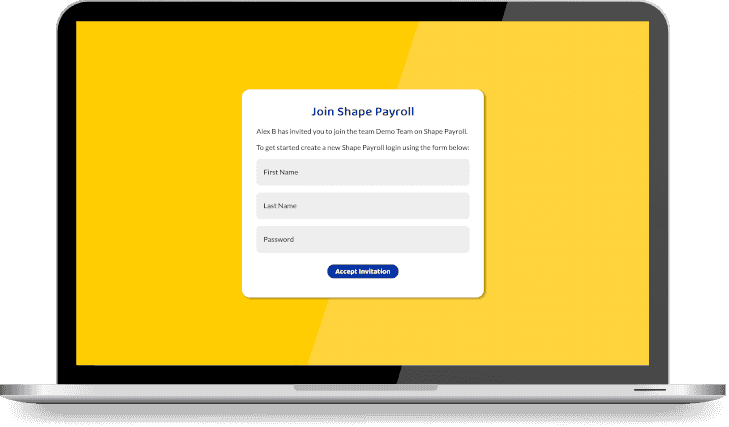

1The Shape Hub, self-serve employee portal

The shape hub allows you to securely issue payslips and other payroll documents to your employees.

Employees can access the hub 24/7 so they won’t need to contact you to request historic payslips.

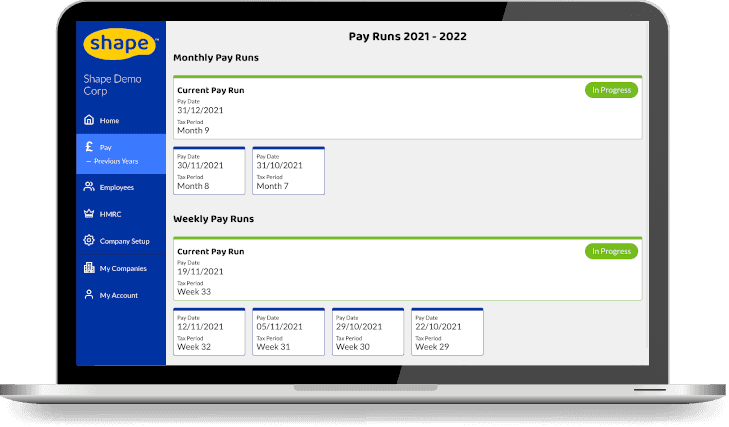

2Run multiple different pay frequencies

Support for Weekly, Fortnightly, Four Weekly, Monthly, Quarterly, Biannual and Annual pay runs.

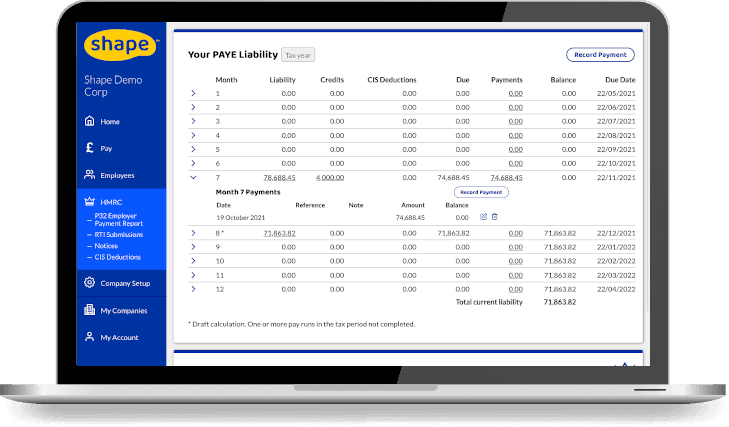

3Keep track of your PAYE liability and payments made to HMRC

You can always see when your next PAYE payment is due right on our dashboard.

Detailed information on liabilities and payments is available at the click of a button.

Includes full support for Quarterly PAYE payments.

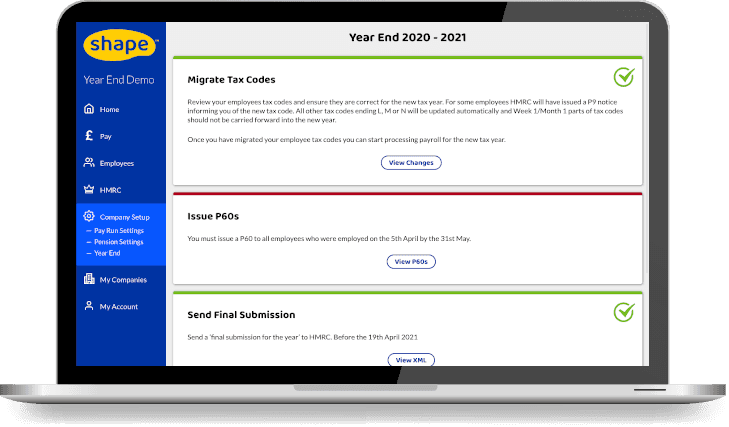

4Year-end

Our easy to use year end process makes the 6th April less stressful.

- Automatically applies P9 notices

- Performs tax code uplifts (where no P9 is issued)

- Generate P60s

- Issue P60s via the employee portal or email