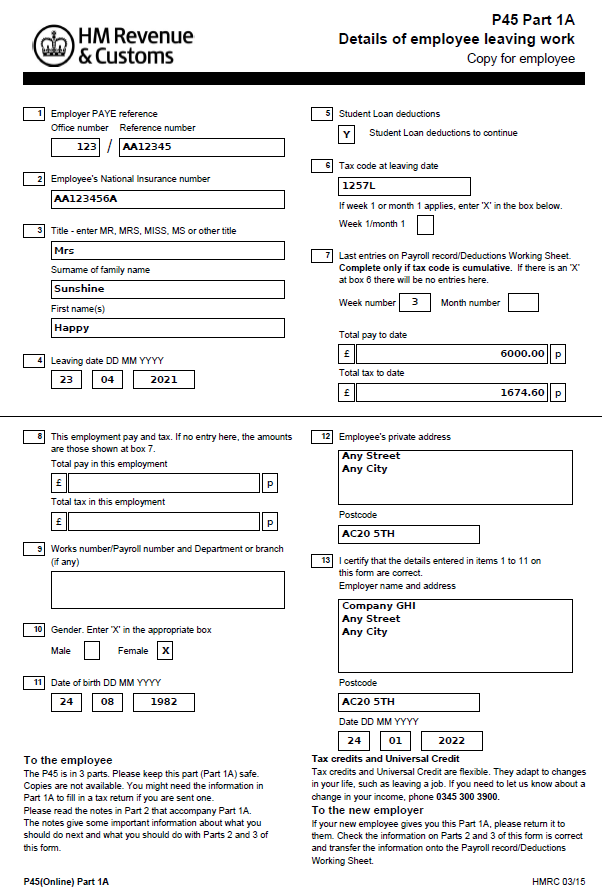

A P45 is a summary of the gross pay and tax paid to an employee during their employment within a tax year up until they leave.

Shape uses the HMRC standard P45 and can be printed onto blank paper.

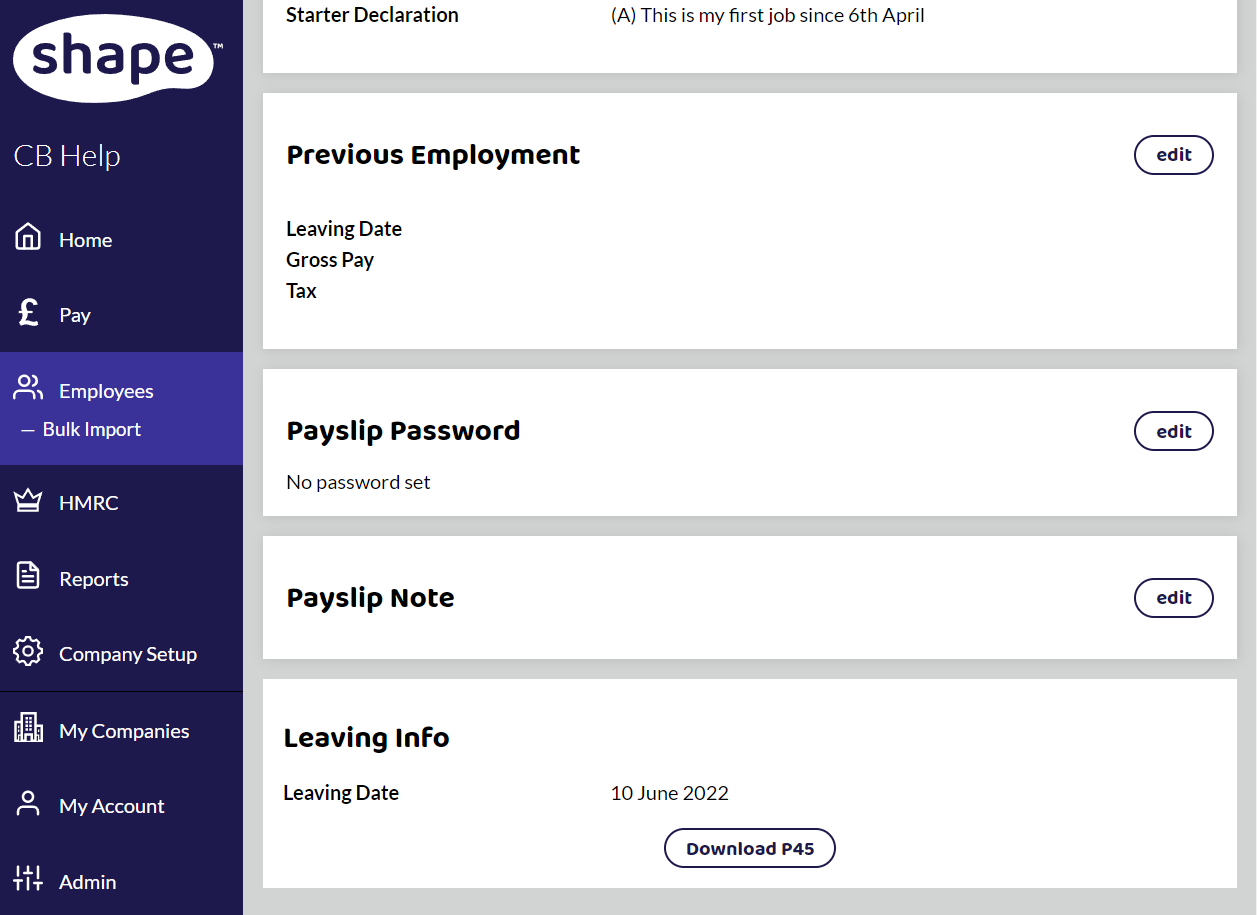

Find the P45

Once you have completed the leaver process, a P45 is produced. It can be found at the bottom of the employee's page.

If it isn't there, then it could be because the last pay run hasn't been completed or the browser needs to be refreshed.

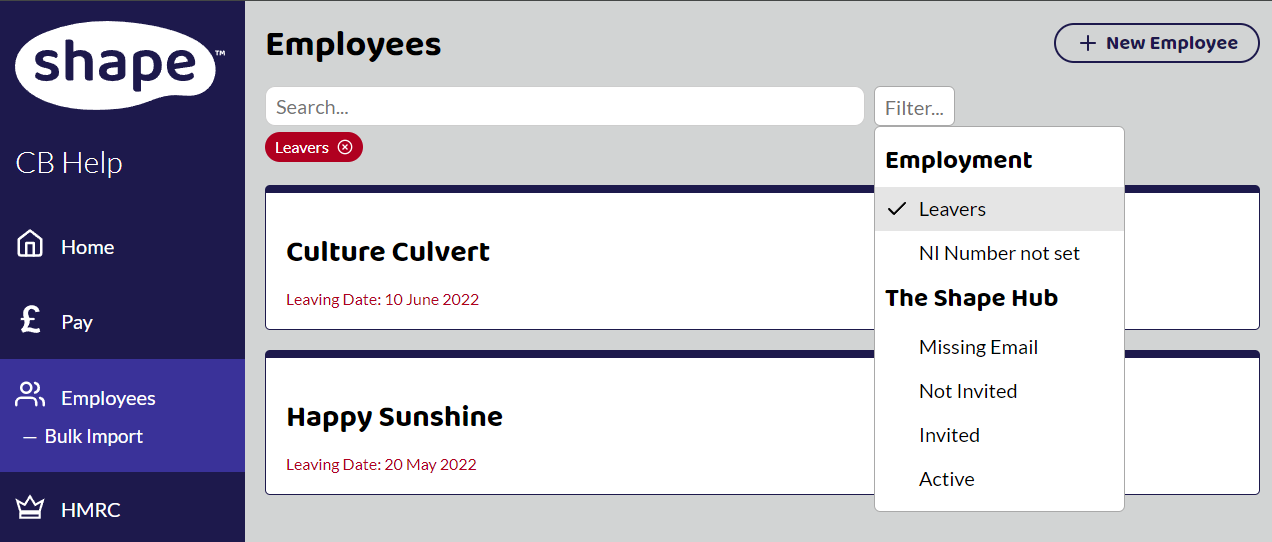

Leaver has disappeared

If the leaver has disappeared, this could be because the employee has been moved into leaver status so that they can't be added to a pay run. Go to Employees and Toggle the Filter button next to the search box, select Leavers and your employee will be shown.