Employers have a duty to assess all employees and automatically enrol them into a pension scheme if they meet the criteria. To find out more on the earnings thresholds and assessment, please see our Automatic Enrolment Guide.

Finding Pension Settings in Shape

When you first sign up to Shape, there will be a red box on the homepage called Pension Setup to show you that you need to complete this step. This box will disappear once complete.

Pension Settings can also be found under Company Setup in the side menu.

What you need to set up your Pension Scheme

Before setting up your pension scheme you will need to find out the following:

Provider and Pension settings

Your pension provider name

Employer reference

Pay reference period - tax month or calendar month.

Contributions

Earnings basis - qualifying or pensionable

Contribution type - Fixed or percent

How much the employee and employer is contributing

If it is a net pay arrangement

Is it a salary sacrifice scheme? Please see the help article for more information on setting this typr of scheme up.

Not all the above information is required for every pension scheme.

Setting up your Pension Behaviour

Before you tell Shape about your pension scheme, you will need to tell Shape how to manage auto enrolment. This is your pension behaviour and helps Shape to know if it needs to assess your employees or not.

Managing automatic enrolment

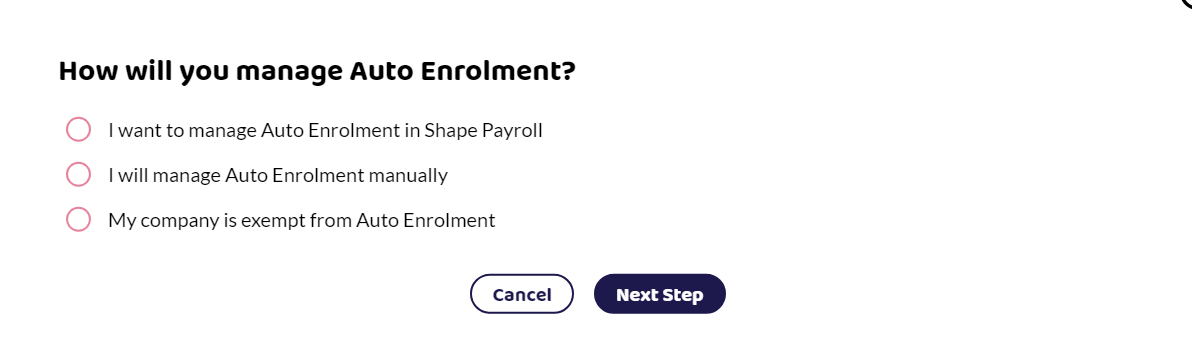

When you first set up your pension behaviour, you are asked to select from the following:

I want to manage Auto Enrolment in Shape Payroll

I will manage Auto Enrolment manually

My company is exempt from Auto Enrolment

To find out more about how Shape manages auto enrolment for you, read automatic enrolment in Shape.

If you choose Shape to manage auto enrolment, you will get further options:

Postponement for new employees

Do you operate a postponement period for new employees? You can choose from

None - no postponement period for new employees. If they meet the criteria, they will need to be auto enrolled from their first pay date.

1 - 12 weeks

1 - 3 months

3 months is the maximum amount of time that an employee can have auto enrolment postponed. If new employees are postponed, they need to be told this. Once the postponement period is up, the software will tell you if they need to be enrolled. The employee can only be postponed once.

Staging Date

This is the date when your duties under automatic enrolment begin. This is normally the date when your first employee starts work for you.

Pension Scheme

If you chose to set up your pension from the homepage, the pension setup will get you to select your pension provider. See below for for further guidance.

Changing pension behaviour settings

If you wish to change any of these settings at a later date, edit the Pension behaviour within the settings. You may wish to do this if you later take on more employees and stop being a director only payroll and therefore stop being exempt from auto enrolment or you wish to edit the postponement period.

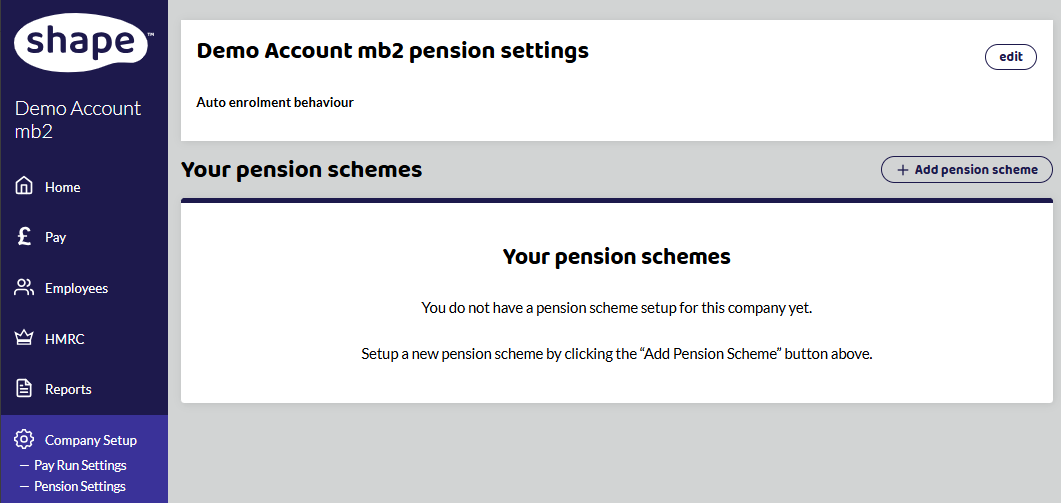

Adding a pension scheme

If you chose to set up your pension from the homepage you'll have been asked to choose your pension provider. If you set it up from the Pension Settings page, you can select +Add Pension Scheme as shown below.

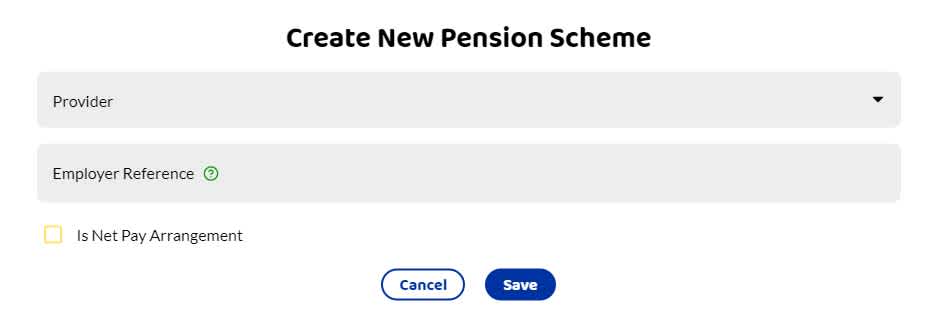

You will now be asked to create new pension scheme. Here you set up your initial information about the pension provider.

The drop down menu will show the following. Enter the required information about the pension provider:

NOW: Pensions

The People's Pension

Smart Pensions

Standard Life

Workers Pension Trust

Creative Pension Trust

Scottish Widows

Other - for pensions that are different from the above.

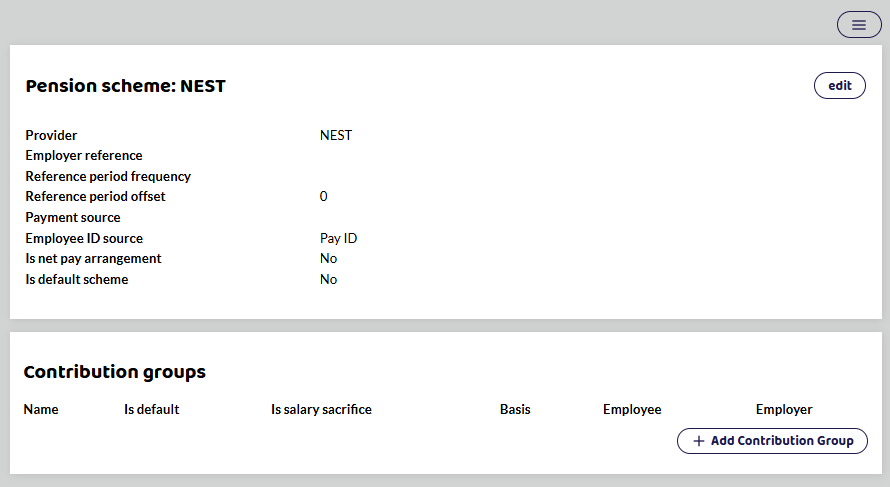

Click Save and you will have a new screen to add a Contribution Group. This is useful if you have different schemes running.

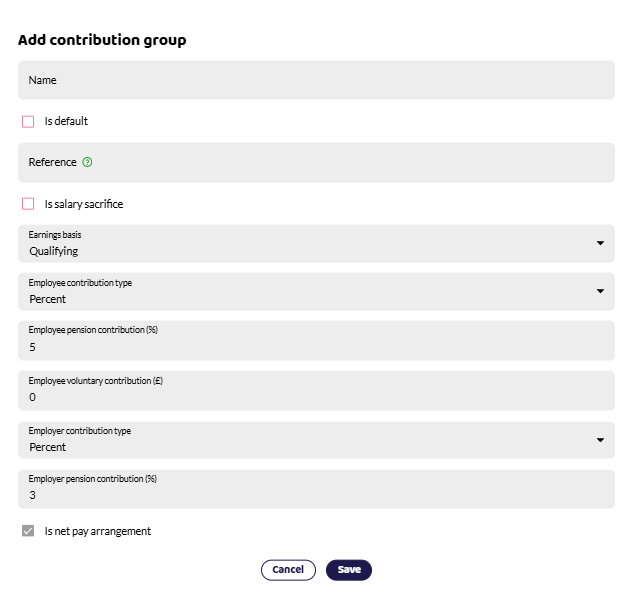

Click +Add Contribution Group

You can name your group, which is useful if you have more than one scheme. Once everything is correct, save.

Adding an employee to a pension scheme

Once you have set up your pension scheme, you will be able to add your employees to the pension scheme. If you have selected Manage Auto Enrolment within Shape Payroll, when you add your employees to a pay run, the software will automatically assess if they should be in a pension scheme.

To add an employee to the pension scheme, you can select Pension Plan in the drop down menu in Enter payments. For more guidance view How to Pay an Employee.

Writing to your Employee

If you need to assess your employee, you need to send them a letter confirming if they have been enrolled. Letter templates from the Pensions Regulator can be found here.

If you are using a pension provider listed below, they may have suitable templates you can download and use or via their online employers portal.

NEST - Employer Notices Templates

The Peoples Pension - Resource Library

Smart Pensions - Found under Documents in Company Details on smart pensions.

Workers Pensions Trust - Resources

Further guidance on your responsibilities as an employer to provide a pension scheme can be found here at The Pensions Regulator.