Submitting a Full Payment Submission (FPS) Late

A Full Payment Submission (FPS) should be sent on or before the pay date. This is the date that you normally pay your employees. If you pay your employees on the 25th of every month, then the FPS needs to be submitted on or before the 25th to avoid a late penalty fine.

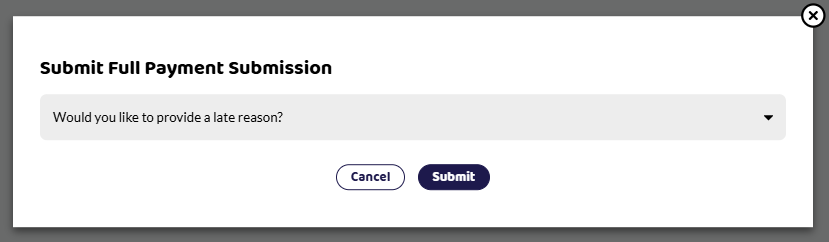

If you submit a late FPS, Shape will automatically prompt you to enter a late reason.

You should always choose a reason from the following options:

(E) Micro Employer using temporary 'on or before' relaxation.

(F) No requirement to maintain a Deductions Working Sheet or Impractical to report work done on the day

(G) Reasonable excuse

(H) Correction to earlier submission - applied automatically if an additional (correction) FPS has been created.

Failure to pick a reason could lead to a late penalty fine. However, choosing a reason, especially if you are regularly late submitting, does not mean a late penalty notice will not be issued.

Submitting an additional FPS

If you have created and are submitting an additional FPS due to a correction, Shape will automatically apply H as a reason for submitting the FPS and you will not be prompted to choose a reason.

Submitting an Employer Payment Summary (EPS) Late

An Employer Payment Summary (EPS) needs to be submitted by the 19th of the following tax month. If you do not submit this until after the 19th and you are reclaiming statutory payments, you will need to pay the FULL amount owed and the amount reclaimed will be applied from the following tax month.

Example

You have statutory maternity pay to claim back on your April monthly pay run. To be able to claim the amount against your owed PAYE liability, the EPS needs to be submitted by the 19th of May. However, it doesn't get submitted until 21st May. This means that HMRC will not credit the PAYE scheme with the reclaimed statutory maternity pay until the 12th of June. This means that no statutory maternity pay will be credited to your account and all your PAYE liability will be due for the April pay run.

Reviewing your HMRC PAYE online account

You should be regularly checking your HMRC government gateway account to check how much HMRC think you owe and to make sure that your FPS and EPS's have been allocated to your account correctly.