Setting up a new employee in your Shape Payroll account only takes a few minutes.

Before you start gather as much of the following information as possible: Employee Name, Address, Date of Birth, Gender, National Insurance Number.

Your employee should provide you with a P45 from their last job. If not, you will need to find out if they have/had another job or pension this tax year and you should use the HMRC starter checklist.

Adding a New Employee

To set up a new employee you have a few ways:

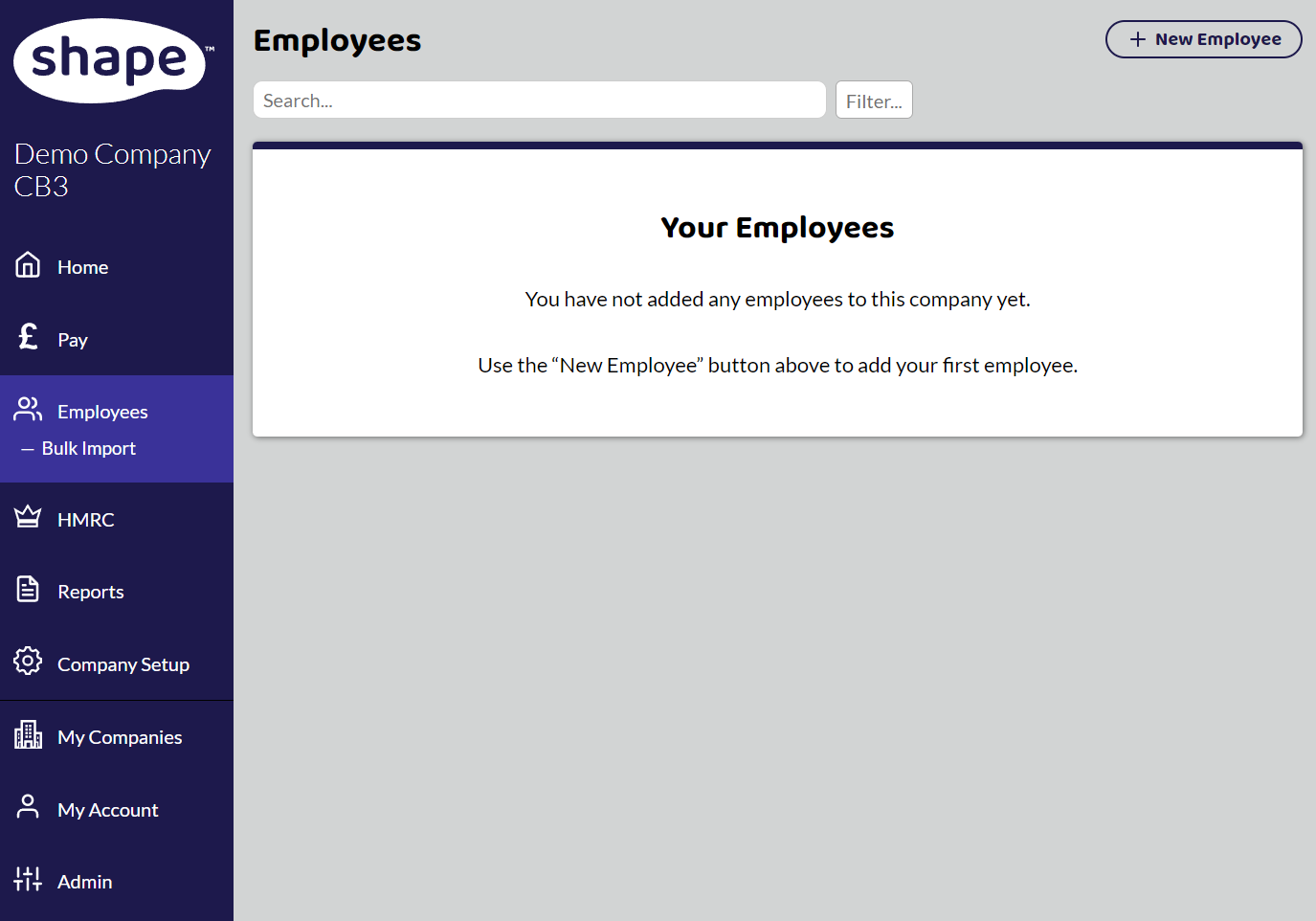

Click Employees in the side menu

Select the + New Employee button on the top right of the screen.

Or

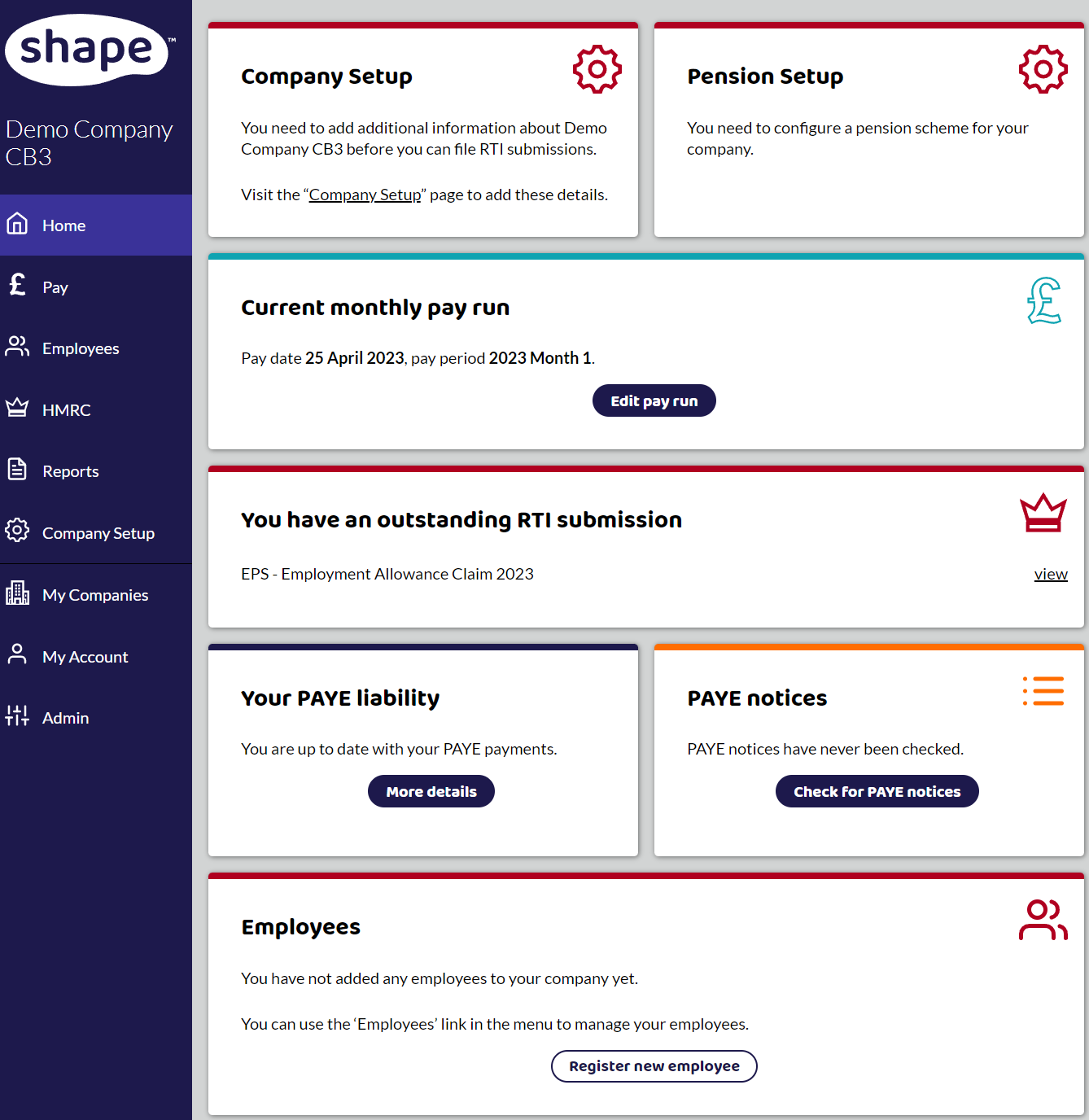

On the homepage, in the Employees task box, select Register a new employee now.

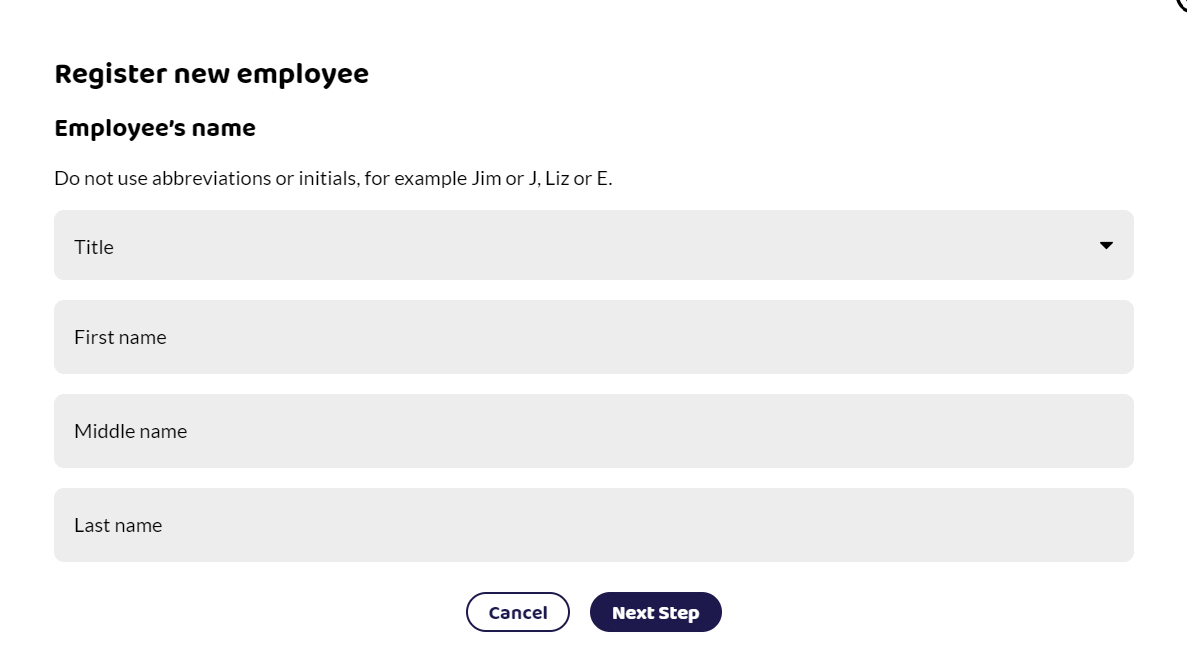

Register New Employee

Both open a Register New Employee starter wizard which takes you through the details needed to set up your employee.

Migrating from another software provider

Use the information on Starter Wizard and then follow our guide migrating from another software provider.