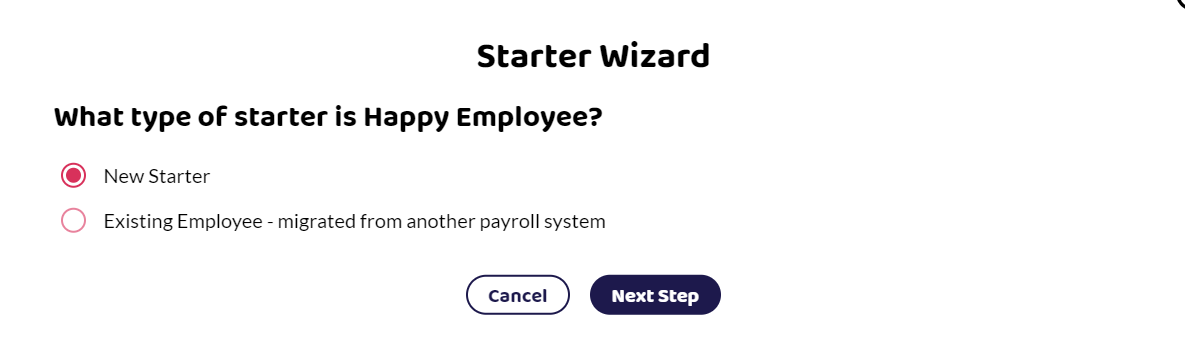

Once you have completed the first section of the Starter Wizard, you will be asked What type of starter is the employee?

Is the employee a:

New Starter

Existing Employee - migrated from another payroll system?

If you are migrating from another payroll software - you would select an existing employee. Please see Migrating Employees for further details on the set up process.

If you have a new starter without a P45, please see the New Starter Checklist.

New Starter - With P45

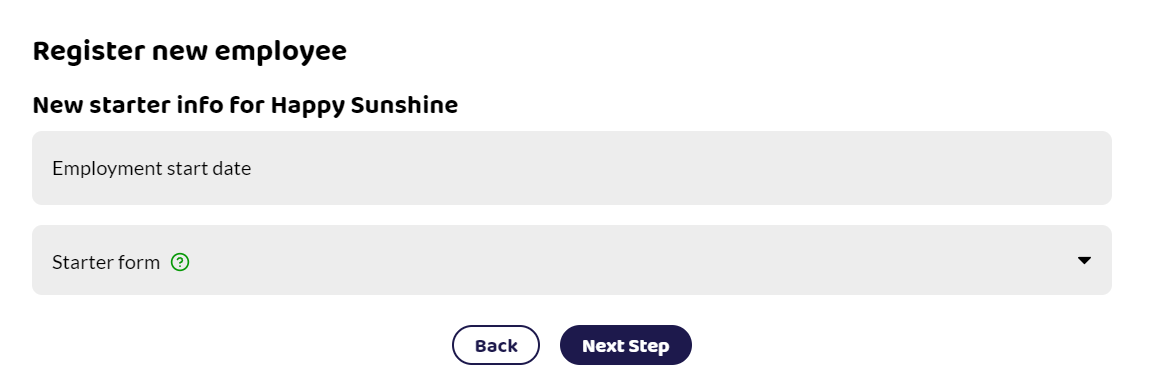

Employment Start Date

This is the date the employee started working and it will be reported to HMRC on the Full Payment Summary (FPS) the first time you pay them.

Starter Form

Select if the employee has a P45 and then either the following will show:

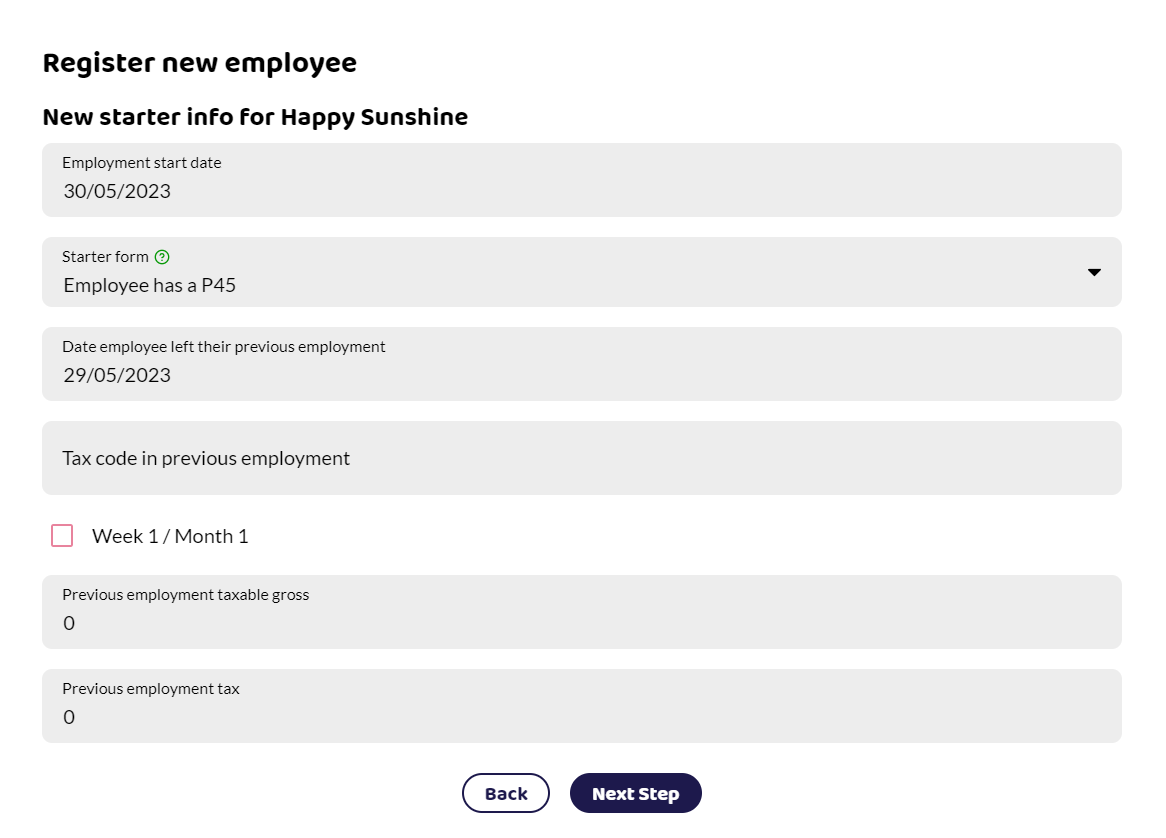

An employee has a P45 (current tax year)

If they give you a P45 where their employment ended in the current tax year you will be asked to add:

Date employee left their previous employment

Tax code in previous employment

Week 1 / Month 1 - Tick this if there is an X in the box next to the Week 1 / Month 1

Previous Employment Taxable Gross

Previous Employment Tax

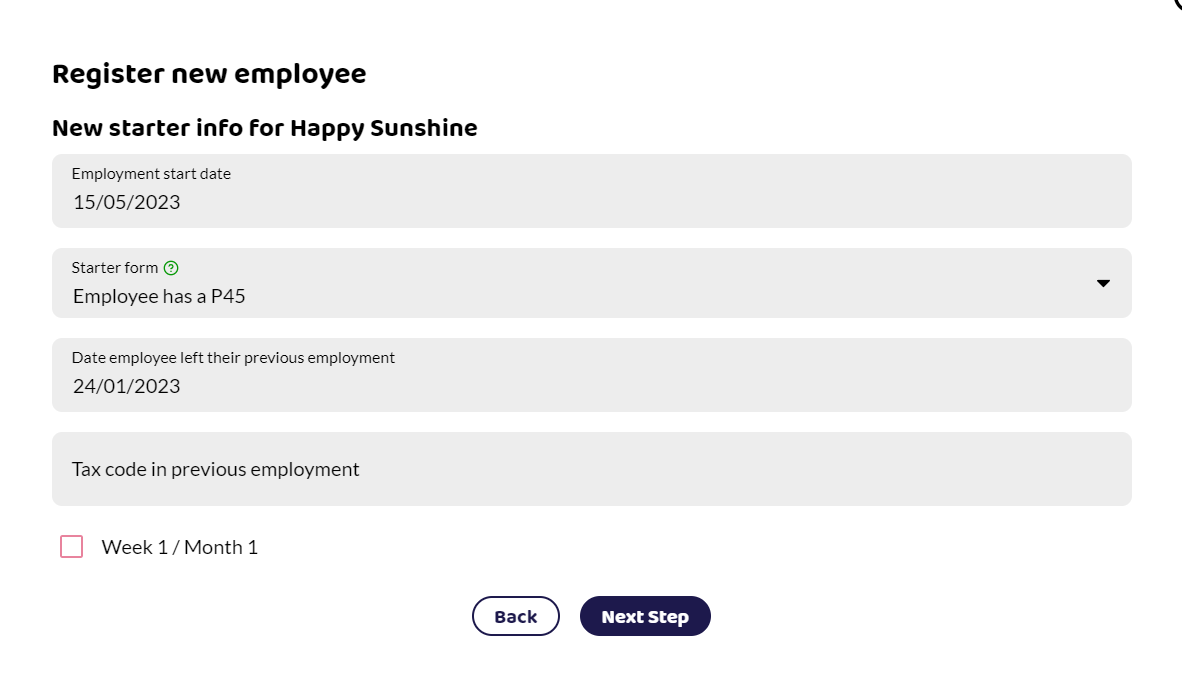

An employee has a P45 (previous tax year)

You will be asked only:

Date employee left their previous employment

Tax code in previous employment

Week 1 / Month 1 - Tick this if there is an X in the box next to the Week 1 / Month 1

There is no need to enter the gross pay and tax as this relates to earning before the 6th April.

An employee started on or after 25th May

If the P45 is in the previous tax year, and the employee started working on or after 25th May, you can still enter the P45 tax code and depending on what the tax code is, Shape will either accept it or move it to the correct tax code.