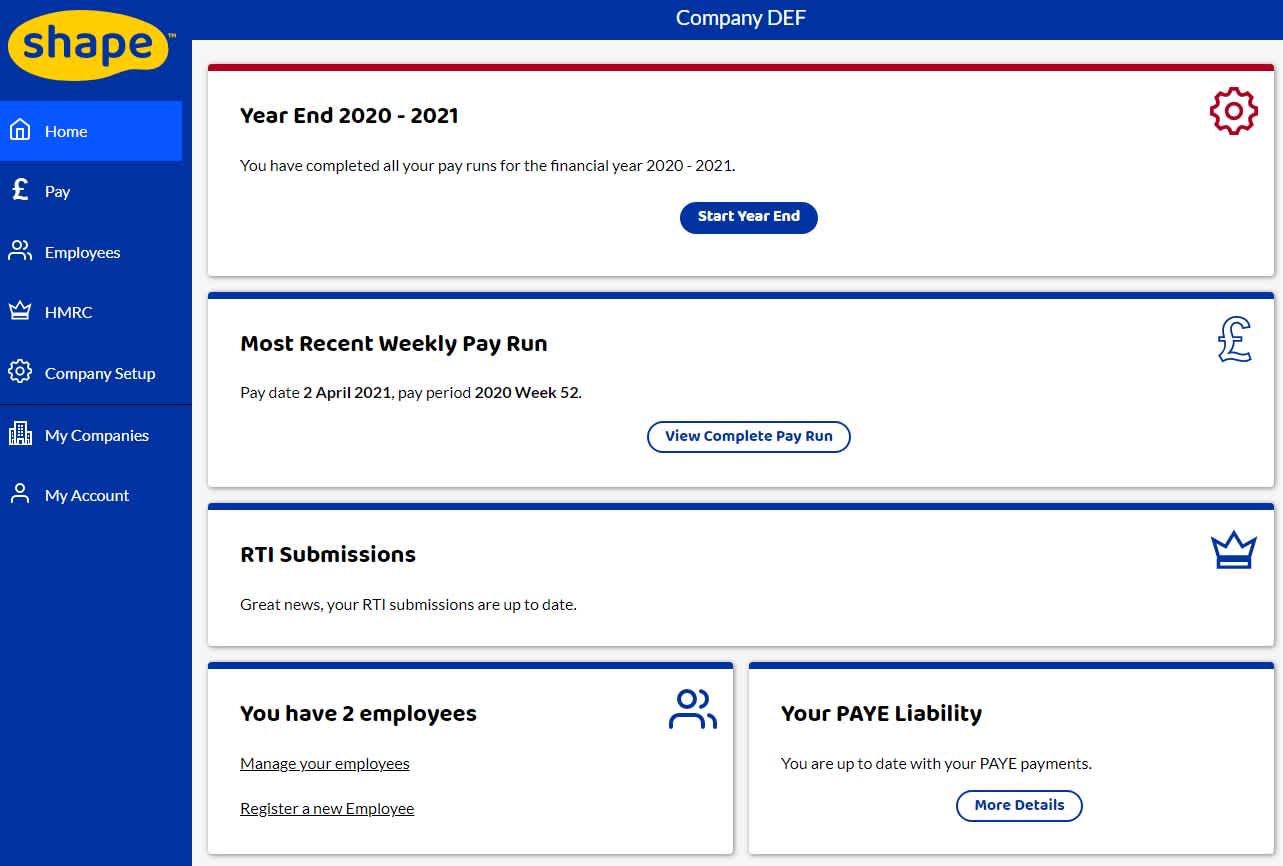

Year end becomes available once you have completed all pay runs for the year and is available towards the end of March to enable you to get ready for the new tax year on the 6th of April.

On your home screen, a box will appear for you to complete year end.

Process Year End

Once you are ready to complete Year End, select Start Year End. You can also find Year End under Company Setup in the side menu.

Make sure you have submitted all your FPS and EPS for the year as once you run year end, you will be sending an EPS to HMRC to indicate you are finished for the current tax year.

If you later need to correct errors in your payroll after your final EPS submission, you can send an Additional Full Payment Submission.

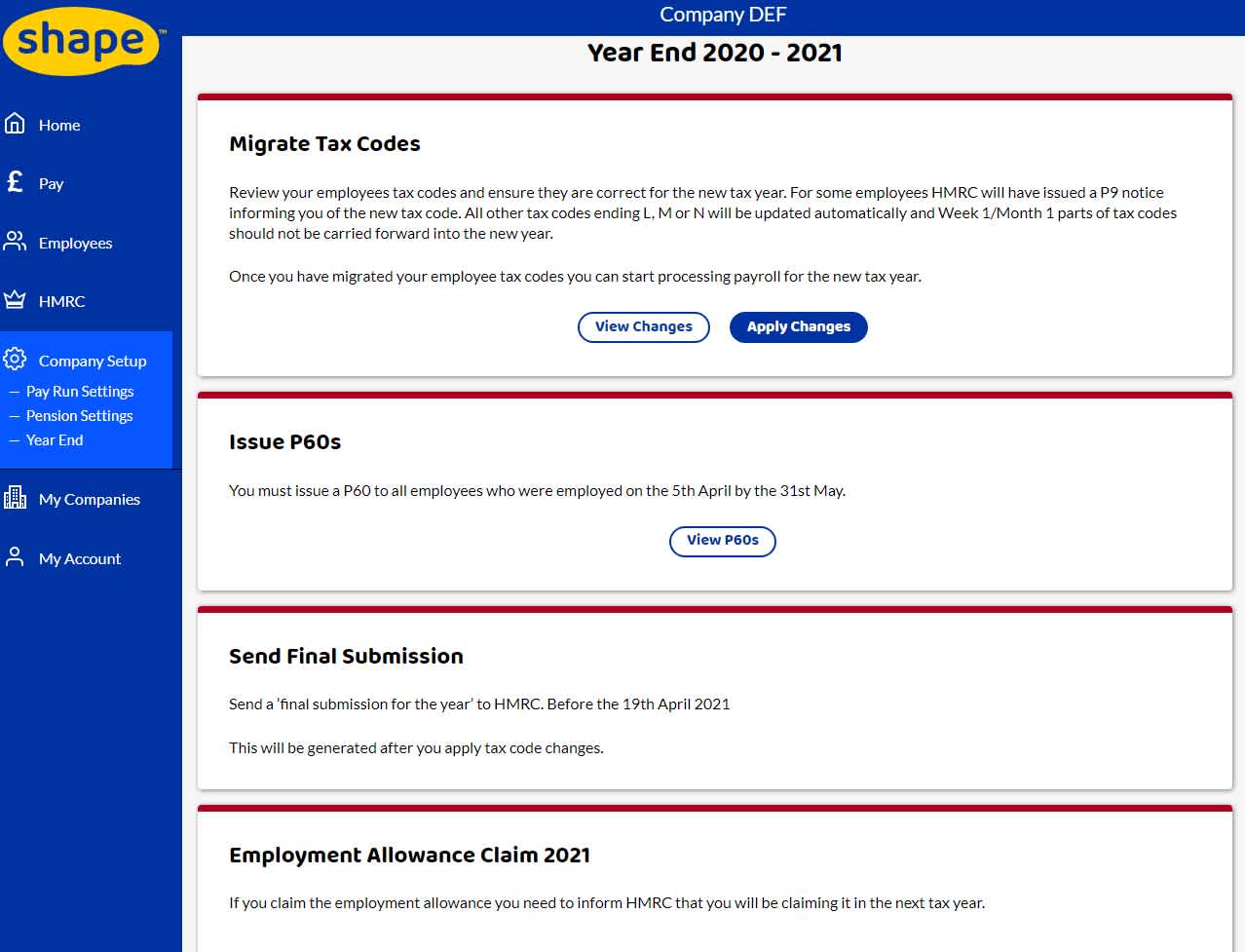

Migrate Tax Codes

For the start of a new tax year, tax codes are changed and the W1/M1 flag needs to be removed. Here is where you will make the changes and apply them to your employees in one go.

Sometimes HMRC issues a P9 tax code notice for an employee where there is a difference from the current year. For example, an employee may have been on a lower tax code but for the new year will be on the standard tax code.

If you have a paid subscription and you have set up your HMRC account to receive tax code notices online, the year end process will check for any P9 notices and apply them.

If you are a free customer and do not receive tax code notice changes through Shape Payroll, you will need to go into your government gateway account or check for a letter from HMRC informing you of any tax code changes. You can then apply the changes in the migrate tax code section.

Once applied you can review all the tax code changes and edit if necessary.

Issue P60s to your employees

This is for all employees who are working for you on the last day of the tax year (5 April). The P60 summarises an employee's total pay and deductions for the year.

A P60 needs to be issued to your employees by 31st May.

Options:

Download P60s - We use a HMRC approved 'substitute' P60. This can be printed on a blank sheet of paper.

Email P60s - Available with a paid subscription.

Shape Hub - If you use the Shape Hub, as soon as you have completed the year end, P60s will be available for employees to view within the portal.

Create an EPS Final Submission

This submission will tell HMRC that you are finished with this tax year and not to expect any more submissions. Needs to be submitted to HMRC by 19th April.

EPS Employment Allowance Claim for the new tax year

If you claimed the employment allowance in the previous tax year, a new EPS claim will be generated for you at year end. You need to apply to HMRC every year to indicate you are eligible for the employment allowance. To read further about eligibility and how to claim please see tax settings.

Note: You can start the new tax year once you have completed the tax code changes. You can come back at a later date to issue the P60s and make your submissions to HMRC.