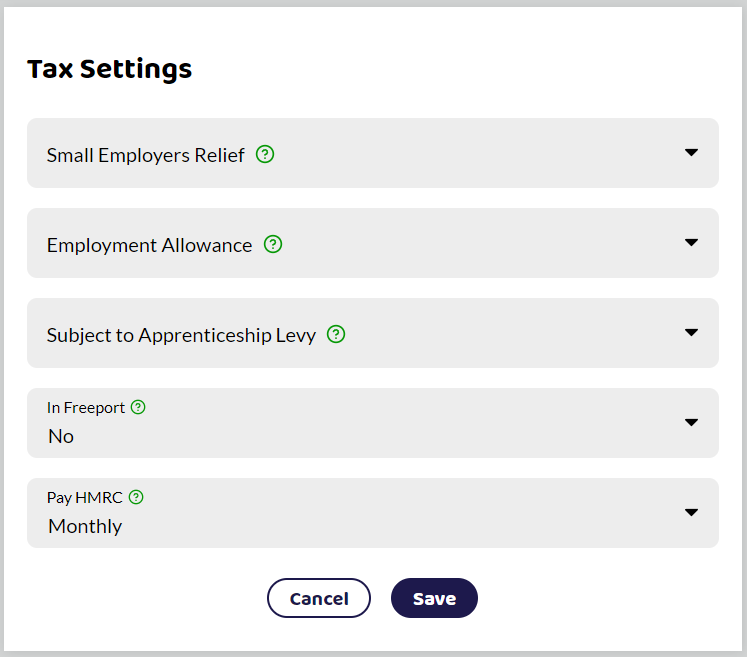

Small Employers Relief

Select if you are eligible or not eligible. This relates to small employers being able to claim back 103% of their statutory payments. Please see Statutory Payments for further information on what can be claimed.

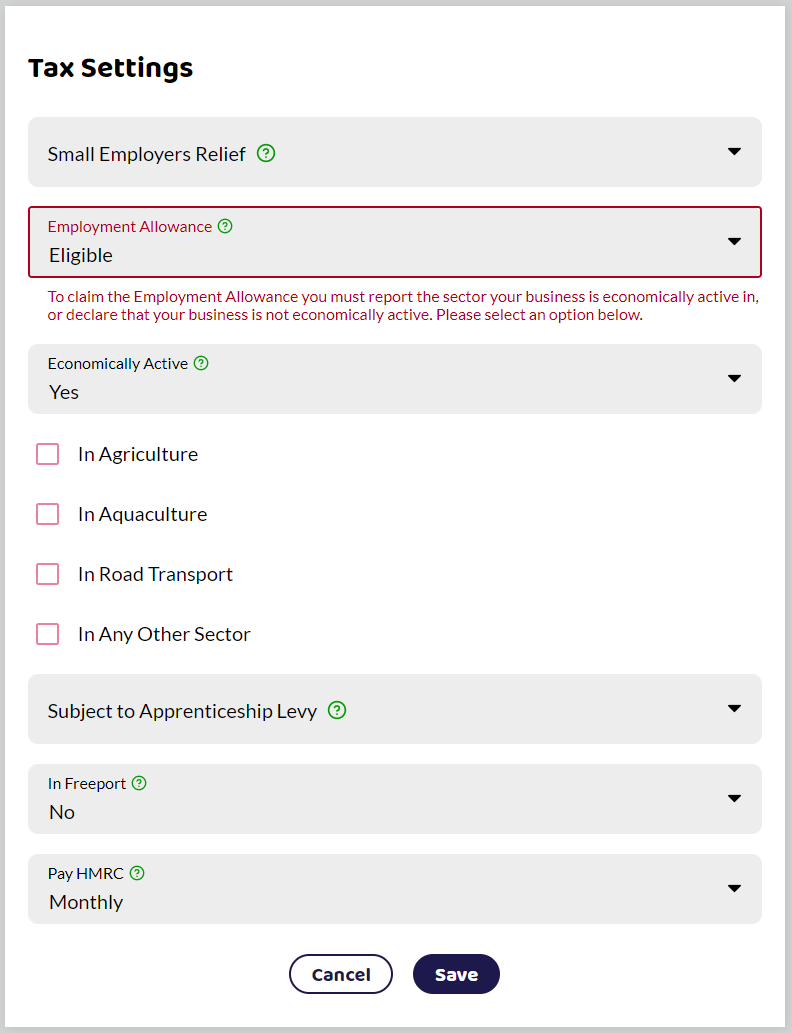

Employment Allowance

Find out more about the employment allowance.

Select if you are eligible or not eligible.

Economically Active

This refers to whether state aid rules apply to your company. For the majority of companies, state aid rules do apply.

But if you do not make or sell goods or services, choose no. For example, if you’re a charity, an amateur sports club or if you employ a care worker.

If state aid rules do apply, you need to select which sectors apply to your business.

The sectors are:

In Agriculture

In Aquaculture

In Road Transport

In Any Other Sector (Industries).

Select all that apply to your business.

See below for HMRC guidance.

Once you have completed this, an EPS - Employment Allowance Claim will be generated for you to file with HMRC to inform them you are eligible. You will be able to find the EPS under HMRC -> RTI Submissions in the side menu. You need to tell HMRC every year if you are eligible. If you run Year End through Shape Payroll, an EPS to claim will be created for the next tax year.

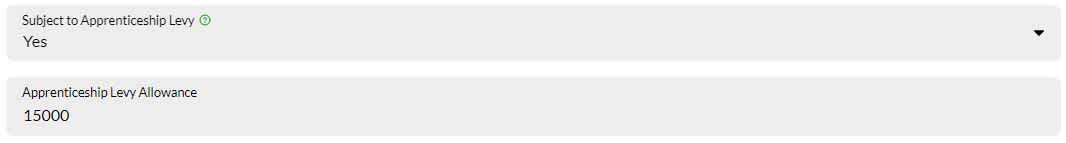

Apprenticeship Levy

Employers that have an annual pay bill of over 3 million have to pay the apprenticeship levy. If you need to pay this, select Yes and enter how much allowance you receive. Once this is set up, each month the Employer Payment Summary (EPS) will be generated for you to submit to HMRC.

In a Freeport

If your company is based in a freeport you can select this to enable you to claim for certain employees. For more information about if you qualify for this, please read HMRC's further guidance on Freeports.

Pay HMRC

Select if you pay your HMRC liabilities Monthly or Quarterly.

If you pay HMRC less than £1,500 per month in PAYE, employees NI and employers NI, you may be able to pay HMRC quarterly. You need to contact the HMRC payment helpline for more information.