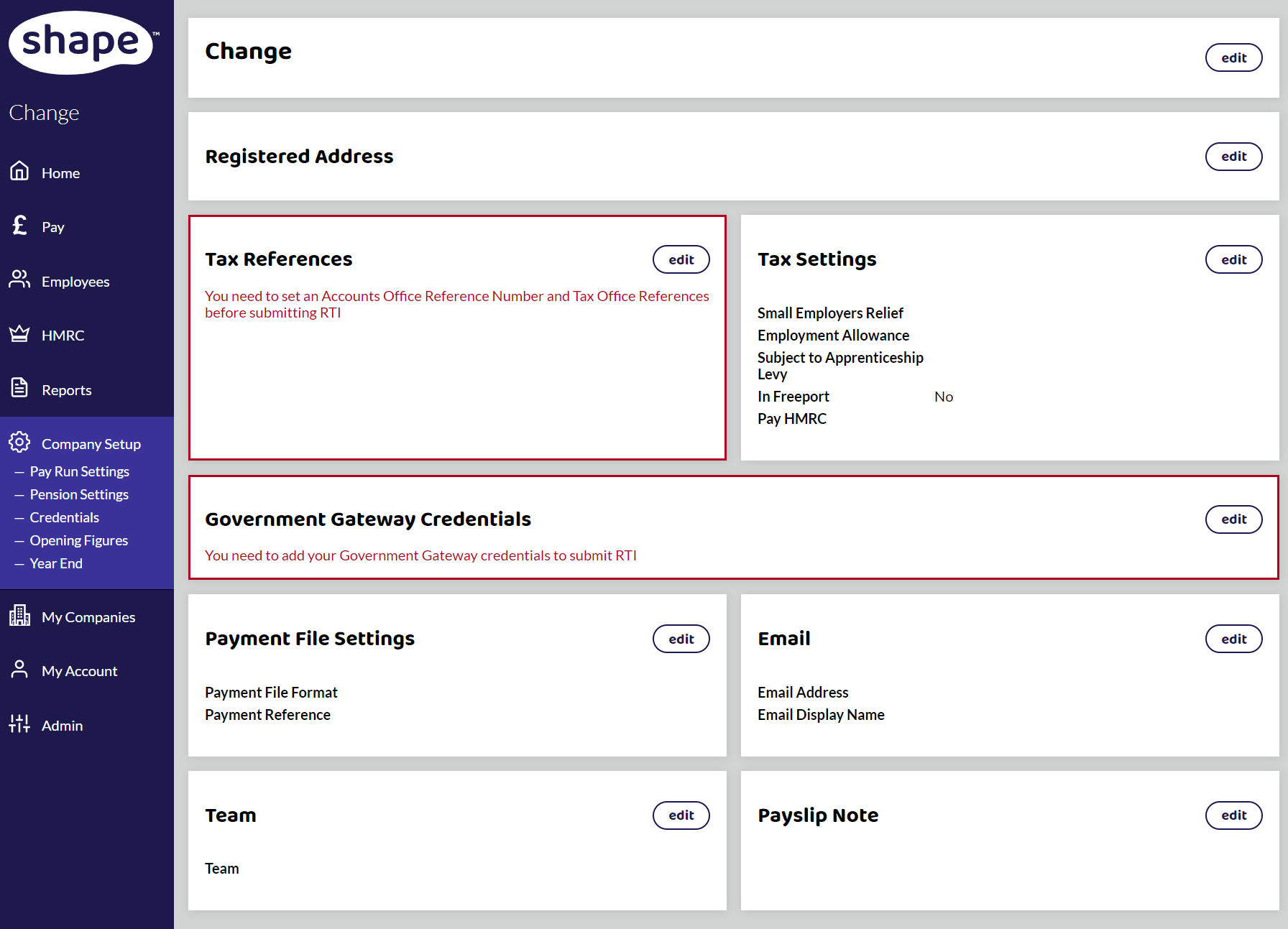

The Company Setup is where you store all the details about the employer. You may find it helpful to gather all the required information before setting it up to save you time.

Select Company Setup in the side menu. When you first look at the Company Setup page, if there are areas highlighted in red, this information is needed before you can submit information to HMRC.

You will see that there are seven sections under Company Setup as well as your company name and registered address details that you can edit.

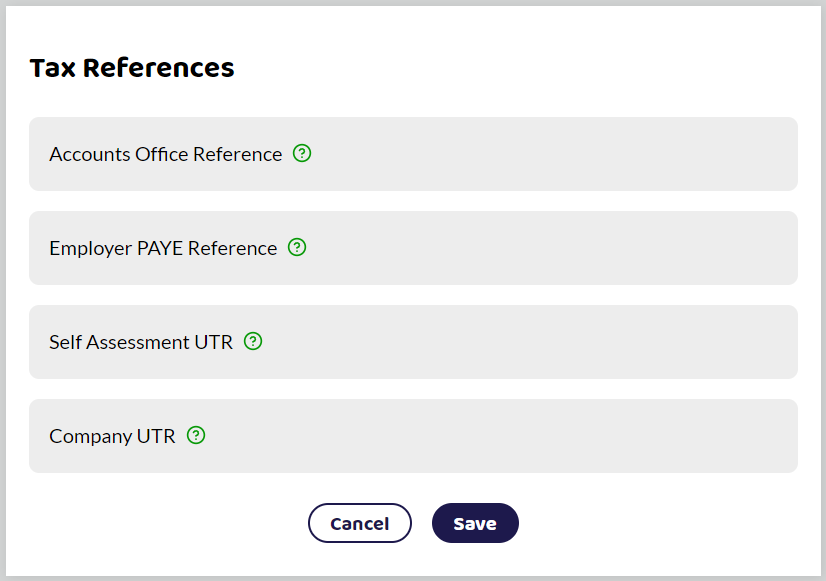

Tax References

The references are what HMRC use to link your submissions to your account. Find out more here: Tax References

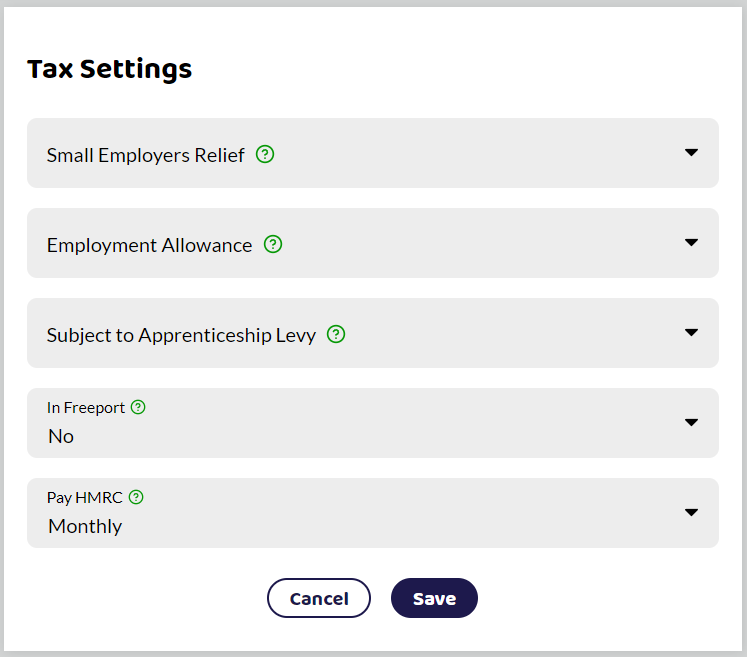

Tax Settings

This is where you can select if you are eligible for small employers' relief, the employment allowance or if you are in a Freeport. Please follow HMRC guidance to check if you are eligible for either of these schemes.

You can select if you have to pay the apprenticeship levy and how often you pay HMRC the PAYE liability.

Find out more in Tax Settings.

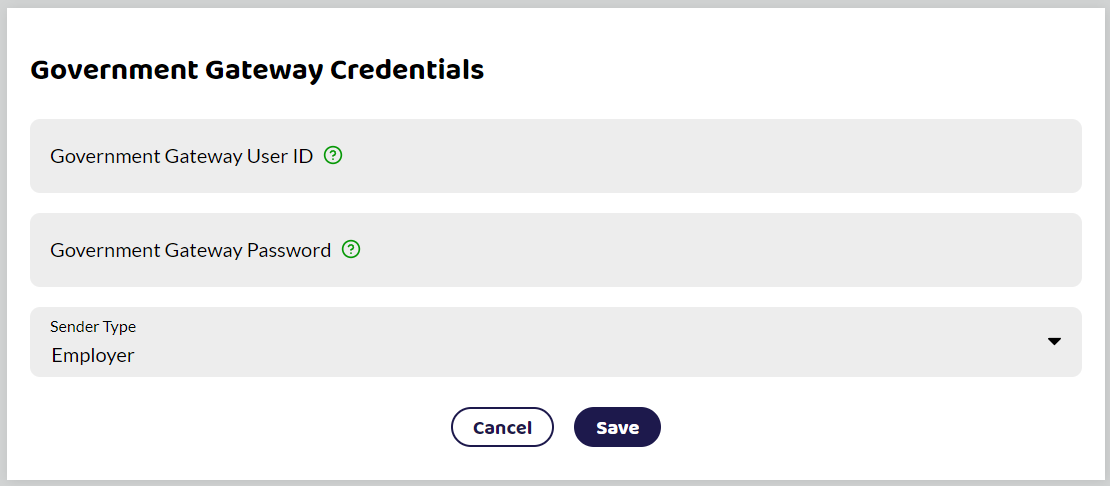

Government Gateway Credentials

Government Gateway User ID and password. This is the information you use to sign into your online business account to view your PAYE scheme details.

Find out more in Government Gateway Credentials.

Without this information, you will not be able to submit your RTIs to HMRC. If you are having issues submitting to HMRC, this is normally the main cause. Please see RTI: Authentication Error for further guidance if you continue to have issues.

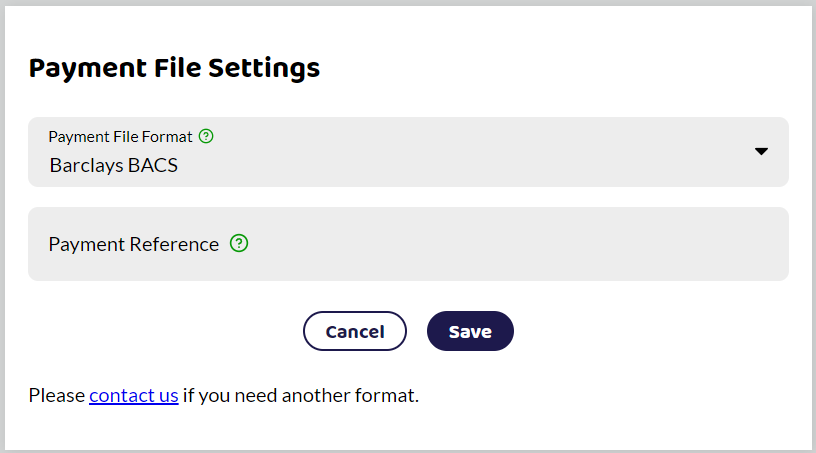

Payment File Settings

Some banks accept payment files that can be uploaded for BACS payments. This is normally only for large companies that have this facility set up. Please see Payment File Settings for more information on the different formats available.

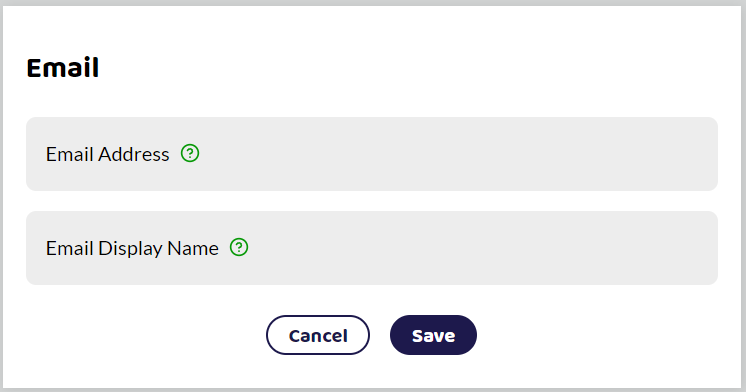

If you have a paid subscription, you can email the payslips straight from the system. Enter the email address you would like the recipients to reply to and the name you want to be displayed. This defaults to your Company Name but you can can change it here if you wish.

Teams

If you run multiple companies, you may wish to grant access to some of the companies only. Further guidance here: Teams.

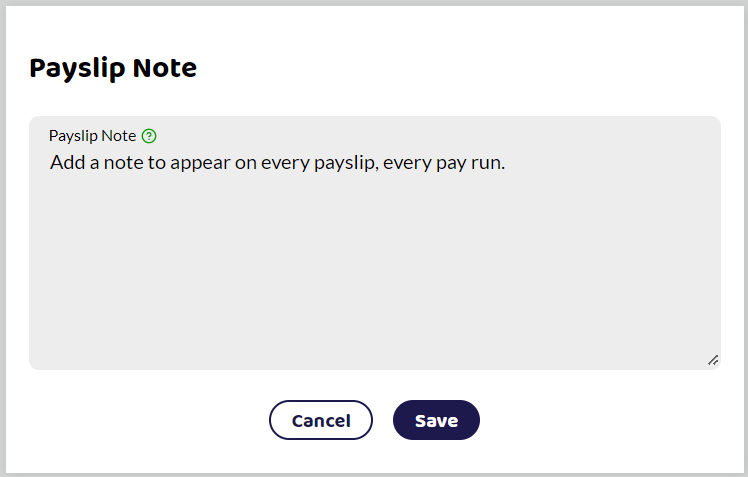

Payslip Note

If there is a company-wide message that needs to be added to every payslip, and every pay run, then it can be added here. If this is updated, then all payslips will be updated to show the message. Payslip messages can also be added to a pay run or an individual payslip. See Payslips and Notes for further details.

Under Company Setup in the side menu, there are five sections:

Click on the links above for further information about these.